Calculate Adjusted R Squared. Mathematically R-squared is calculated by dividing sum of squares of residuals SSres by total sum of squares SStot and then subtract it from 1. A fund has a sample R-squared value close to 05 and it is doubtlessly offering higher risk adjusted returns with the sample size of 50 for 5 predictors. The adjusted R-squared is a modified version of R-squared that adjusts for the number of predictors in a regression model. To Find Adjusted R square value.

Sample size 50 Number of predictor 5 Sample R - square 05Substitute the qualities in the equation. R-square value and adjusted r-square value 0957 0955 respectively. The adjusted R-squared is a modified version of R-squared that adjusts for the number of predictors in a regression model. It is calculated as. To Find Adjusted R square value. Video Further Resources Summary.

On the other hand R-squared blithely increases with each and every additional independent variable.

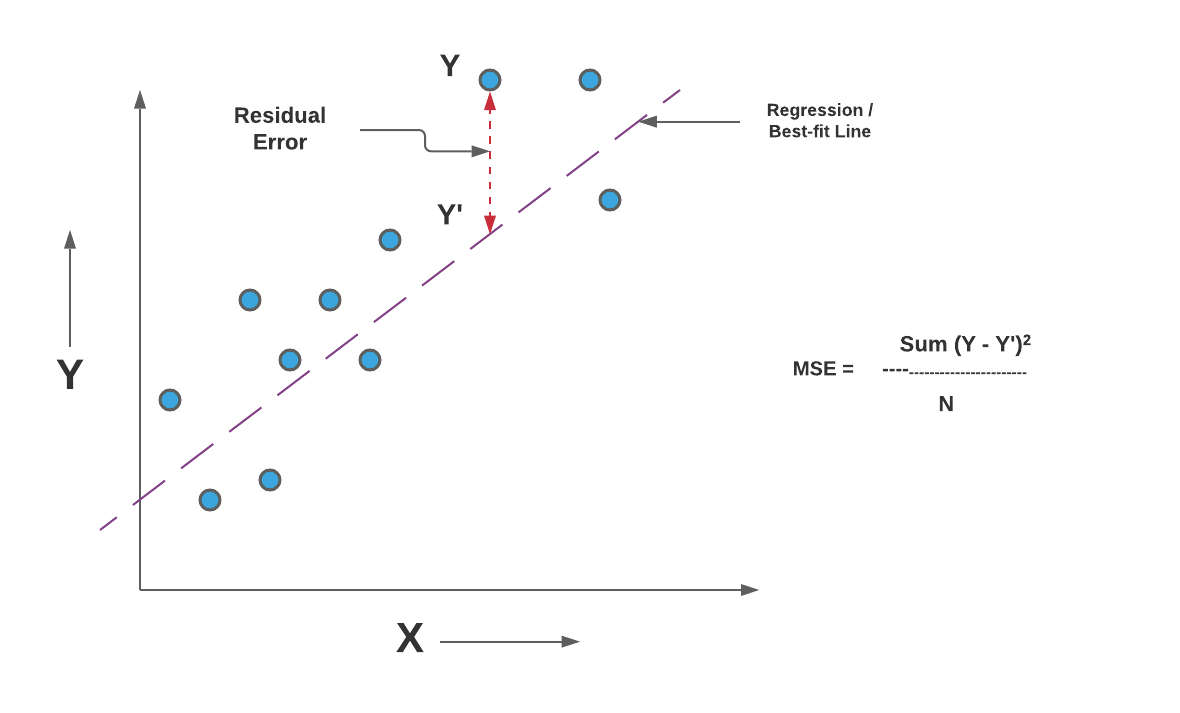

Total Sum of Squares TSS Residual Sum of Squares RSS Explained Sum of Squares ESS. It is calculated as. Alternatively to the multiple R-squared we can also extract the adjusted R-squared. It is calculated as. In statistics the coefficient of determination denoted R2 or r2 and pronounced R squared is the proportion of the variation in the dependent variable that is predictable from the independent variable s. Total Sum of Squares TSS Residual Sum of Squares RSS Explained Sum of Squares ESS.